In currently’s fast-paced and unpredictable organization surroundings—especially over the various markets of the Middle East and Africa—accessing precise, trusted, and well timed specifics of the businesses you are doing company with is no longer optional. Business Credit Reports have grown to be an essential tool for businesses seeking to handle credit history hazard proficiently, prevent high priced defaults, and make informed conclusions.

1. Make Self-assured Credit rating Decisions with Trusted Knowledge

An extensive firm credit report supplies an in-depth overview of a company’s fiscal steadiness, operational historical past, payment conduct, and lawful standing. With this particular information and facts at your fingertips, your crew can:

Evaluate creditworthiness before extending phrases or presenting funding

Recognize purple flags like late payments, lawful disputes, or deteriorating financials

Mitigate risk by customizing credit score boundaries and phrases for every customer or provider

This is particularly important within the MEA region, in which publicly readily available financial information is usually restricted or inconsistent.

2. Enhance Danger Management Throughout Borders

Accomplishing business throughout many international locations in the Middle East and Africa indicates coping with various regulatory systems, amounts of transparency, and economic conditions. Enterprise credit rating experiences give you a standardized danger profile, helping you to:

Evaluate providers across marketplaces working with constant credit rating scoring

Recognize local context, which include alterations in company legislation or country chance

Create a regional credit score coverage based on actual facts in place of assumptions

three. Protect Your organization from Payment Defaults

Among the prime explanations companies endure income circulation challenges is because of delayed or unpaid invoices. Corporation credit rating stories enable lower this possibility by presenting:

Payment heritage insights, exhibiting how promptly a company pays its suppliers

Credit rating score trends, indicating improving upon or worsening habits eventually

Alerts and updates, and that means you’re informed of any substantial modifications which will have an impact on payment reliability

Remaining proactive, in lieu of reactive, aids you steer clear of avoidable losses and sustain a healthy stability sheet.

four. Streamline Onboarding and Homework

When bringing on new clients, partners, or sellers, a business credit report simplifies and accelerates your due diligence course of action. With just one document, you may evaluation:

Small business registration and possession structure

Crucial money ratios and once-a-year turnover

Individual bankruptcy records, lawful judgments, and regulatory flags

This accelerates determination-earning while ensuring compliance with internal danger policies and exterior polices such as anti-cash laundering (AML) specifications.

5. Strengthen Negotiating Power and Strategic Planning

A transparent comprehension of your counterpart’s economic overall health provides you with leverage in negotiations. You can:

Regulate payment phrases, like demanding advance payment or shorter credit history cycles

Prepare for contingencies, by identifying suppliers or prospects who may well present possibility

Prioritize partnerships with organizations which are economically stable and lower danger

From the MEA region, the place financial shifts can happen promptly, this foresight is essential to shielding your company passions.

6. Assist Portfolio Checking and Reporting

If you’re handling a considerable portfolio of clients, vendors, or borrowers, retaining monitor of every entity’s credit score overall health generally is a important obstacle. Enterprise credit history experiences assist you:

Observe changes over time with periodic updates

Phase Company Credit Report your portfolio by possibility stage, market, or geography

Create actionable insights for internal reporting or board-amount discussions

This permits for superior strategic arranging, compliance reporting, and All round credit hazard governance.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Richard "Little Hercules" Sandrak Then & Now!

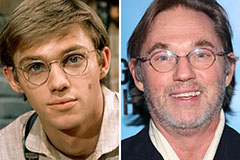

Richard "Little Hercules" Sandrak Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Batista Then & Now!

Batista Then & Now!